Don’t bother filing your taxes yet — the politicians will probably just screw them up anyway.

The first big fight of the year at Arizona’s Capitol is over enacting Donald Trump’s tax cuts in Arizona, and it’s about to cause an administrative nightmare.

A quick refresher: Arizona levies its own income tax, but it uses the federal income figure as the starting point. And since Congress overhauled the federal tax code last year, the typically routine act of conforming Arizona’s tax code to the federal code has turned into a huge state budget problem.

Plus, it’s an election year, and both sides want the credit: Gov. Katie Hobbs for the broadly appealing income tax breaks, and Republicans for passing Trump’s full slate of tax cuts.

The fight is over which of the federal tax cuts Arizona should adopt, and how much money it can afford to give back to its citizens amid already strained finances.

There are two tax plans currently on the table: Republicans’ near-full conformity bill and Hobbs’ version, which carves out some of the largest corporate tax breaks.

The Republicans’ plan cuts about $190 million more from the state’s coffers this fiscal year than Hobbs’ does.

That’s because Hobbs’ version is a limited adoption of the federal tax cuts that Trump enacted in the “Big Beautiful Bill” that she calls her “Middle Class Tax Cuts Package.” It adopts most of H.R.1’s individual income tax cuts, but not the new deductions for corporations, or — as the governor put it in her State of the State speech — “tax breaks for billionaires.”

Republicans, meanwhile, want to adopt almost all of Trump’s tax cuts plus a little bit more, like write-offs for child care expenses and retirement account contributions.

Yesterday, Republicans started fast-tracking their version of the tax cut plan through the state Capitol, holding a rare joint House and Senate committee to skip the usual chamber-to-chamber ping-pong.

Their plan would cost Arizona roughly $1.1 billion over the next three years, according to state budget crunchers. And it doesn’t clarify what the state budget will cut to make up for the lost revenue.

That’s a huge concern for Democrats.

“It is a backwards way to budget to say, ‘First, let's cut all the revenue, and then let's look at our expenses,’” Democratic Sen. Mitzi Epstein said.

Still, Republicans hope to put their plan on Hobbs’ desk by the end of the week, even though Hobbs is all but certain to veto it.

“Their proposal gives hundreds of millions of dollars in tax breaks to special interests, removes a tax cut for working seniors, and adds even more handouts to those who are already rich,” Hobbs said in a press release that was pushed out after the committee meeting.

Hobbs’ tax deductions | GOP tax deductions | Both plans’ deductions |

|---|---|---|

$6,000 for seniors aged 65+ | $6,000 for seniors aged 60+, but only on retirement distributions | Tips and overtime income |

Interest on car loans for new, American-made vehicles | $6,000 for contributions made to Roth IRAS | Increases the standard deduction |

Raises the dependent tax credit from $100 to $125 per child under age 17 | Maintains $10,000 limit on state and local tax deductions (rejecting the federal increase to $40,000) | |

Extra write-off for child care costs beyond what the federal care credit covers | ||

Corporate-specific deductions |

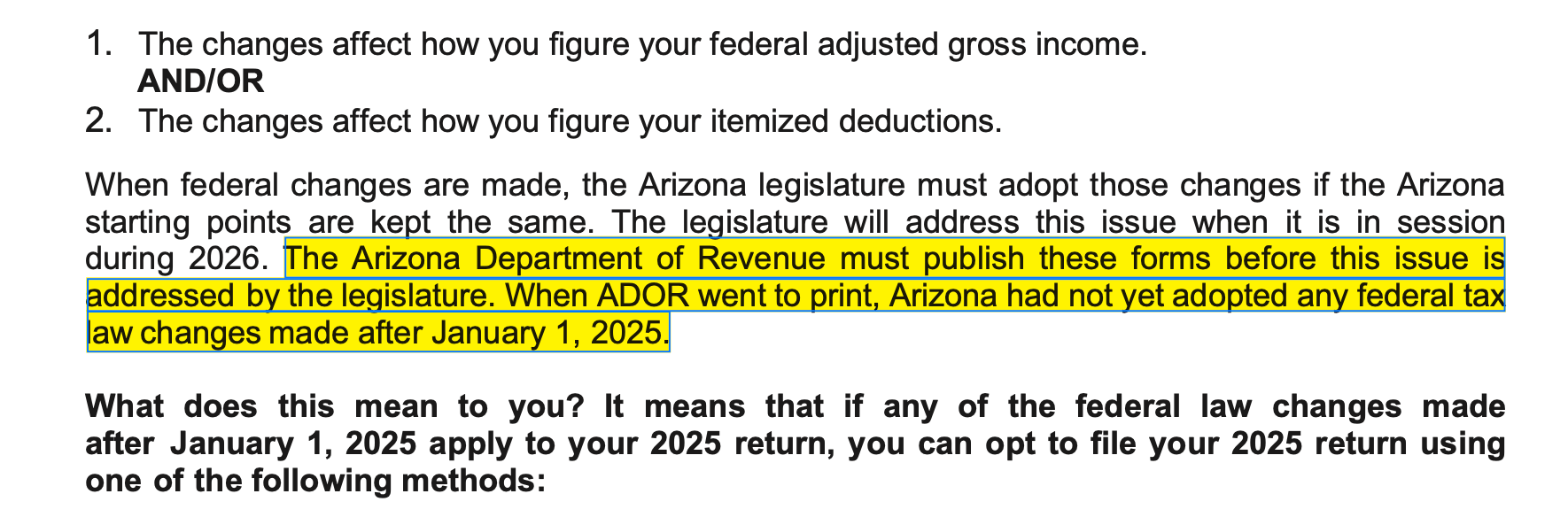

And although the two sides agree that tax cuts are coming, the how and when are critical.

If our politicians can't resolve the issue quickly, the state won’t be able to update its forms on time — and Arizonans could have to refile or amend their taxes after our political leaders finally hash out a deal.

The worst-case scenario, per Republican Sen. JD Mesnard, chair of the Senate Finance Committee, is that taxpayers file expecting a deduction that never materializes — and then have to refile once politicians settle on the final parameters.

“The taxpayers of Arizona are screwed, because the due date for their tax filings will happen before they even know what the rules are,” he said.

Not only can the two sides not agree on the scope and size of the cuts that Arizonans will receive, but they can’t even get into the same room together to talk about it.

Republican Rep. Justin Olson said the joint committee asked Hobbs’ office to present at yesterday’s hearing, but her office never replied.

Christian Slater, Hobbs’ spokesperson, said the invitation came three hours before the committee meeting started, and Republicans didn’t reach out to the executive office to negotiate before then.

But both sides had months to sort this out after Congress passed the new federal tax code in July — well before Arizona’s Department of Revenue issued income-tax forms that, at Hobbs’ direction, effectively blend full federal conformity with pieces of her plan.

That means the current income tax forms don’t match either plan that lawmakers are currently discussing.

“One unfortunate thing in all of this process, and this began in November, is the enormous uncertainty, the muddy waters that this whole process has created,” Mesnard said. “The governor inserted herself in that process in an unprecedented way.”

Meanwhile, Republican Rep. David Livingston offered a pressure valve for budget constraints under the GOP tax plan: a Prop 123 renewal.

Lawmakers temporarily backfilled the major public-school funding stream last year instead of sending it to voters for renewal, which means tax dollars are covering Prop 123 instead of state land trust money. Republicans want to tether any extension to constitutional protections for school vouchers — an even bigger nonstarter for Hobbs than corporate tax cuts.

During his vote explanation, Livingston said he’d support a “clean as possible” version of Prop 123 — meaning voucher-free — in exchange for Republicans’ tax plan, but he specified the idea didn’t come from GOP leadership.

Livingston does have some leverage as the chair of the appropriations committee, however.

“If the governor asked us to pass a budget and be done by March 31, we can do that,” he told us. “But I have no incentive as approps chair, right now, to work on the state budget. This topic has to be solved first.”

IN OTHER NEWS

Angling for a seat at the table: A pair of Republican lawmakers who are running for the Corporation Commission say Arizonans have overpaid $2.3 billion on their electric bills, partly because utilities said they needed the money to meet renewable energy goals, per Capitol scribe Howie Fischer. Reps. David Marshall and Ralph Heap blame former Arizona Corporation Commission member and current Attorney General Kris Mayes for adopting “expensive renewable energy surcharges.” HB2269 would repay customers by pulling the money from sales tax revenue on utility bills, which would cut state revenues by $687 million.

Something everyone agrees on: GOP Rep. Nick Kupper introduced the “Own Something and Be Happy Act” yesterday, which he says is “aimed at preventing large institutional investors from dominating Arizona’s single-family housing market.” Among other provisions, the bill would block institutional investors from bidding on homes for 60 days after the homes are listed for sale. Kupper pointed to President Donald Trump recently calling for banning institutional investors from buying single-family homes, while Rep. Oscar De Los Santos, a Democrat, said they’re both trying to copy him.

Protect Big Brother: Police associations are backing a bill from Republican Sen. Kevin Payne that would shield data gathered by license plate readers, such as the controversial Flock cameras, from public records requests, the Arizona Mirror’s Jerod MacDonald-Evoy reports. If the bill were already law, the public might never have known that a Glendale police officer used an anti-Romani slur last year or that Arizona police have used the tech to spy on protesters.

Oversight costs money: After the Arizona Auditor General found last year that state education officials weren’t actually checking how schools used grants from the School Safety Program, Republican Rep. Matt Gress wants to divert $98 million to a new School Safety Center that would conduct oversight on the grant funds, per the Mirror’s Caitlin Sievers.

Do you know who’s really good at oversight? Reporters. Invest in more of them by clicking this button!

AI boom keeps booming: Arizona could soon be home to even more high-tech computer chip factories, as the Trump administration works out a deal with the Taiwanese government, the Wall Street Journal reports. Under the proposed deal, the U.S. would lower tariffs and Taiwan’s biggest company, TSMC (which already has plants in the Phoenix area) would invest $300 billion in the states. New plants in the Phoenix area would produce logic chips used in the artificial intelligence industry.

In other, other news

Republican Rep. Selina Bliss wants Arizona’s voters to decide whether trans students can play on the team of the gender they identify with (Richard Ruelas / Republic) … A conversation among four members of the Scottsdale City Council in an office didn’t violate state public meetings laws, Arizona Attorney General Kris Mayes found (J. Graber / Scottsdale Independent) … U.S. Rep. Yassamin Ansari is calling for an end to for-profit detention centers as the Trump administration’s mass deportation program ramps up (Morgan Fischer / New Times) … At least six public schools in the Valley have closed this school year, and experts say the school voucher program, declining birth rates and higher home prices are to blame (Erick Trevino / Arizona Republic) … Nick Mansour, the only major Democratic candidate for state treasurer, wants the Legislature to renew Prop 123 and if elected, he’d crack down on the $1 billion school voucher program (Peter Aleshire / Payson Roundup).

TODAY’S LAUGH

Every day, we have to log in to Elon Musk's hellscape to check in on the lowest common denominator of political discourse in America.

It's part of the job!

And while it's especially depressing to watch humanity turn over even its stupidest Twitter beefs to Grok — an AI bot that, as we discuss in today’s AI Agenda, creates deepfake porn of real people, including of children — we did get a kick out of logging in yesterday to see someone try to "own" the Agenda by asking Grok if we go soft on Democrats.

While Grok's answer was technically wrong (Rachel hasn't been with the Agenda since 2023), we do appreciate its assessment of the Agenda as covering both parties factually.